Peptide CDMO 2.0 Market Forecast to 2034: Emphasizing Integrated and Tech-Forward CDMOs

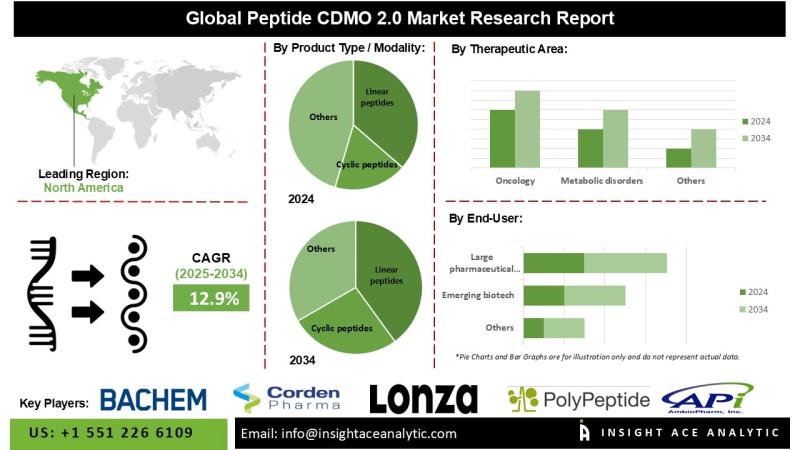

The global Peptide CDMO 2.0 market is expected to expand at a CAGR of

12.9% during the forecast period from 2025 to 2034.

Peptide CDMOs 2.0 are prioritizing adaptable and flexible manufacturing platforms. This includes multipurpose production systems and modular facility designs, allowing for quick adaptation to changing regulatory requirements and the various demands of peptide therapeutics. A crucial aspect is the ability to rapidly scale production, from accommodating seasonal variations to large-scale manufacturing of widely used drugs like GLP-1 agonists, in order to produce peptides with complex sequences and modifications.

Peptide CDMOs play a crucial role in early-stage drug discovery and commercial manufacturing. They achieve this by providing research-grade peptides, creating peptide libraries for high-throughput screening, producing modified peptides (such as stapled, cyclic, or PEGylated) to improve stability and activity, and supporting target validation research to assess protein-protein interactions and receptor binding.

Technological Advancements in Peptide CDMOs

The advent of Peptide CDMO 2.0 has transformed traditional manufacturing methods through the incorporation of advanced data analytics, automation, AI-driven process optimization, and continuous manufacturing. These advancements have led to faster development times, greater yields, and improved cost-effectiveness. The utilization of continuous-flow systems and advanced synthesis technologies, including solid-phase and liquid-phase peptide synthesis, has significantly enhanced scalability and reproducibility, enabling seamless transitions from clinical-scale production to full commercial manufacturing. Furthermore, these capabilities encourage innovation in complex peptide formats, such as peptide-drug conjugates and cyclic peptides, while also accelerating time-to-market. Health tracking apps like

Shotlee can help monitor the effects of peptide therapeutics.

Market Drivers

The peptide CDMO market is experiencing strong growth due to the increasing demand for peptide therapeutics in various therapeutic areas, including metabolic and cardiovascular disorders, oncology, and infectious diseases. The market is further supported by the expansion of outsourcing strategies by both established pharmaceutical companies and emerging biotech firms, along with increasing regulatory acceptance of peptide-based drugs and rising investments in biologics research. CDMOs with comprehensive end-to-end manufacturing capabilities, AI-enabled systems, and advanced infrastructure are set to play a vital role in accelerating the commercialization of next-generation peptide therapies, thereby shaping the future of precision medicine.

Key Players in the Peptide CDMO 2.0 Market

- Lonza Group AG

- CordenPharma

- Bachem Holding AG

- AmbioPharm

- PolyPeptide Group

- Evonik Health Care

- WuXi AppTec / WuXi TIDES

- Thermo Fisher Scientific (Patheon)

- Olon S.p.A.

- NOF Corporation

- Curapath

- eTheRNA Manufacturing

- Helix Biotech

- Phosphorex

- Creative Peptides

- Peptron Inc.

- Pepscan

- CSBio

- Neuland Laboratories

- Asymchem

- Sai Life Sciences

- AmbioPharm Shanghai

- Hybio Pharmaceutical

Market Dynamics

Drivers:

The rising global prevalence of chronic diseases, such as obesity, cardiovascular disorders, and cancer, is significantly increasing the demand for peptide and oligonucleotide therapeutics. These treatments offer personalized approaches tailored to individual patient profiles, making them particularly valuable for managing complex, long-term illnesses. As chronic disease rates continue to rise globally, pharmaceutical companies are increasingly collaborating with CDMOs to develop innovative therapies based on peptides and oligonucleotides. The trend toward personalized medicine is further fueling the demand for these therapeutics.

Across therapeutic areas like oncology, metabolic disorders (including

diabetes and obesity), neurology, infectious diseases, and rare diseases, the increasing adoption of peptides is a major factor driving the market. Blockbuster drugs, such as GLP-1 receptor agonists like

liraglutide and

semaglutide, highlight the need for scalable manufacturing solutions to meet the growing global demand.

Furthermore, there is growing interest in modified peptides that offer enhanced stability, efficacy, and bioavailability, including lipidated, PEGylated, stapled, and cyclic variants. The rapid advancement of Peptide-Oligonucleotide Conjugates and Peptide-Drug Conjugates (PDCs) further illustrates the industry's move toward individualized and precision medicine, underscoring the importance of advanced CDMO capabilities.

Challenges:

For startups and smaller firms, high production costs and the technical complexities involved in peptide synthesis pose substantial challenges. The regulatory frameworks governing peptide therapies are frequently stringent, requiring adherence to multiple standards established by authorities like the FDA. Extended timelines and increased costs associated with regulatory approvals may discourage some companies from pursuing therapeutics based on peptides.

Regional Trends

North America is anticipated to hold the largest market share throughout the forecast period, driven by significant investments in peptide therapeutics and a leading position in biopharmaceutical research and development. Peptide CDMOs in the region are well-positioned to offer specialized development and synthesis services that align with the increasing emphasis on biologics and personalized medicine, including the production of high-purity linear and cyclic peptides.

On the other hand, the Asia Pacific region is projected to experience the fastest market growth due to expanding pharmaceutical infrastructure, favorable cost structures, and increasing demand for peptide therapeutics. CDMOs in this region are implementing advanced technologies like continuous-flow synthesis, AI-driven process optimization, and automated solid-phase peptide synthesis (SPPS) to improve efficiency and innovation. For example, WuXi TIDES expanded its capacity for cyclic and linear peptides in January 2024 by establishing two advanced manufacturing facilities in Taixing and Changzhou, China, integrating digitalized processes and automated SPPS to support the expanding therapeutic pipeline.

Recent Developments

- In January 2024, WuXi AppTec introduced two new peptide manufacturing facilities, one in Changzhou and the other at their new Taixing API site in China, which tripled their overall peptide synthesis capacity and increased the total Solid-Phase Peptide Synthesis (SPPS) reactor volume to 32,000 liters. These advanced facilities utilize automated solvent delivery systems and digital operations to enhance scalability, consistency, and production efficiency.

- PolyPeptide and Numaferm entered into a Preferred Partner Collaboration Agreement in May 2023 for peptide development and production. This collaboration utilizes Numaferm's sustainable peptide manufacturing expertise and biochemical production platform, alongside PolyPeptide's cGMP manufacturing capabilities, market access, and regulatory expertise. The company specializes in producing and developing proteins and peptides. The parties have agreed to keep the specifics of the agreement confidential.

Global Peptide CDMO 2.0 Market Segmentation

By Product Type / Modality

- Linear peptides

- Cyclic peptides

- Stapled peptides

- Peptide-drug conjugates (PDCs)

- Peptide-oligonucleotide conjugates

- GLP-1 and related long-acting analogues

- Oral peptide formulations

By Scale of Operation

- Preclinical

- Clinical (Phase I-III)

- Commercial

By Business Model

- Tech-Enabled CDMOs (automation, AI, data integration)

- Niche-Focused CDMOs (rare diseases, complex peptides)

- End-to-End Integrated CDMOs

- Sustainability-Driven CDMOs

By Technology Platform

- Solid Phase Peptide Synthesis (SPPS)

- Liquid Phase Peptide Synthesis (LPPS)

- Hybrid SPPS-LPPS

- Enzymatic/biocatalytic synthesis

- AI-assisted synthesis optimization

By Therapeutic Area

- Oncology

- Metabolic disorders (incl. obesity/diabetes)

- Infectious diseases

- Rare & genetic disorders

- Cardiovascular

- Neurology

By End User

- Large pharmaceutical companies

- Emerging biotech

- Academic & research institutions

By Region

- North America-

- Europe-

- Germany

- The UK

- France

- Italy

- Spain

- Rest of Europe

- Asia-Pacific-

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America-

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Middle East & Africa-

- GCC Countries

- South Africa

- Rest of the Middle East and Africa