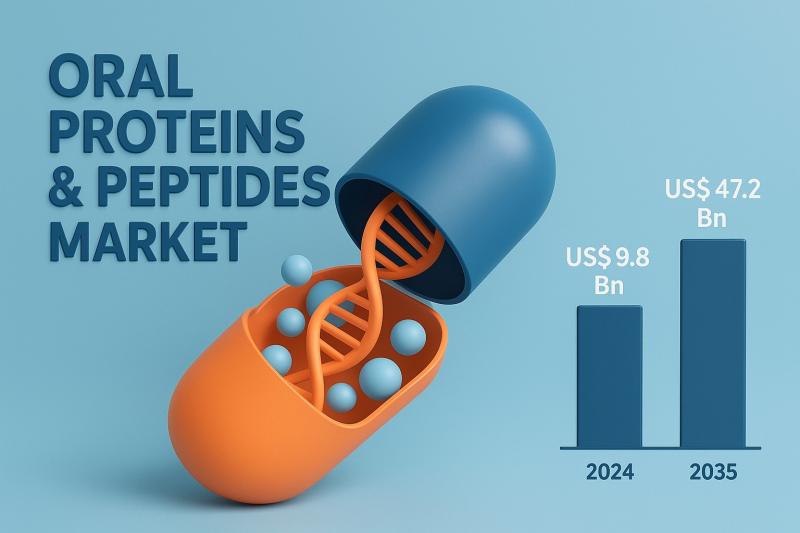

Oral Proteins & Peptides Market Outlook 2035

The global market for oral proteins and peptides, valued at US$ 9.8 billion in 2024, is anticipated to reach US$ 47.2 billion by 2035. This represents a compound annual growth rate (CAGR) of 15.3% from 2025 to 2035. The market's swift expansion is fueled by a rising demand for therapeutics based on proteins and peptides, an increasing incidence of chronic illnesses, and progress in oral delivery methods. Innovations in peptide stabilization, formulation, and enhanced bioavailability are expediting adoption across pharmaceuticals, nutraceuticals, and functional food sectors.

Market Overview

Oral proteins and peptides are biologically active molecules administered through oral formulations to treat or manage various medical conditions. These molecules provide therapeutic advantages similar to injectable biologics, but offer improved patient compliance, ease of administration, and greater market accessibility.

The industry benefits from increasing research in peptide therapeutics and enhanced drug delivery systems. Examples of the latter include enteric coatings, nano- and micro-encapsulation, and enzyme inhibitors, all of which enhance stability and absorption. Growing interest in peptide-based nutraceuticals, supplements for weight management, and metabolic health further bolsters market growth. Health tracking apps like Shotlee can help monitor the effectiveness of these supplements.

Analyst Viewpoint

The Oral Proteins & Peptides Market is moving away from traditional injectable biologics towards oral delivery platforms, which enhance patient adherence and broaden therapeutic reach.

Analysts highlight three major trends that are shaping the market:

- Enhanced Oral Bioavailability: Innovative formulations and carriers are improving the absorption and stability of oral peptides.

- Therapeutic Diversification: Applications are expanding market potential across diabetes, oncology, gastrointestinal disorders, and metabolic diseases.

- Patient-Centric Solutions: Oral formulations are favored for chronic therapies because of their convenience and fewer injection-related complications.

Companies that are concentrating on scalable, safe, and cost-effective solutions for oral protein and peptide delivery are well-positioned for substantial growth.

Analysis of Key Players in the Oral Proteins & Peptides Market

Leading companies in the oral proteins and peptides market are prioritizing product innovation, strategic partnerships, and clinical validation to strengthen their market positions. These companies are heavily investing in R&D, especially in advanced microfluidic and non-invasive delivery technologies. They are also expanding distribution networks and providing integrated service solutions to boost customer loyalty and market reach.

Prominent players in the global market include:

- Novo Nordisk A/S

- AbbVie Inc.

- Pfizer Inc.

- Merck & Co., Inc.

- Johnson & Johnson Services, Inc.

- Sanofi S.A.

- AstraZeneca PLC

- GlaxoSmithKline PLC

- Novartis AG

- Eli Lilly and Company

- Biocon Limited

- Oramed Pharmaceuticals Inc.

- Proxima Limited

- Chiesi Farmaceutici S.p.A.

- Tarsa Therapeutics Inc.

- Other Prominent Players

These players are concentrating on expanding their product pipelines, establishing collaborations, and broadening their geographic reach to reinforce their market presence and improve therapeutic coverage.

Key Developments in the Oral Proteins & Peptides Market

- January 2025: AbbVie acquired Nimble Therapeutics for USD 4.6 billion, gaining access to Nimble's oral peptide IL23R inhibitor, which is currently in preclinical development for psoriasis, thereby expanding its immunology pipeline.

- December 2024: Merck entered a global licensing agreement with Hansoh Pharma for HS-10535, an investigational oral GLP-1 receptor agonist. Under this USD 1.9 billion deal, Merck secured exclusive rights to develop, manufacture, and commercialize the compound.

Key Growth Drivers

- Rising Prevalence of Chronic Diseases: The increasing rates of diabetes, cardiovascular disorders, and obesity are driving the demand for oral peptide therapeutics.

- Advances in Oral Delivery Technologies: Microencapsulation, nanocarriers, and enzyme inhibitors are improving drug stability and absorption.

- Patient Convenience & Compliance: Oral formulations are reducing barriers related to injections, thereby improving adherence and patient outcomes.

- R&D Investment & Innovation: Increased clinical trials and research into novel peptides are fueling market expansion.

- Growth in Nutraceutical Applications: Functional foods and dietary supplements containing bioactive peptides are gaining popularity.

Opportunities

- Next-Generation Oral Peptides: Development of GLP-1 analogs, insulin mimetics, and peptide-based vaccines.

- Integration with Digital Health: Smart pill technologies and adherence monitoring systems.

- Emerging Markets: Expansion in Asia-Pacific and Latin America due to improving healthcare infrastructure and affordability.

- Combination Therapies: Oral peptide formulations combined with conventional drugs for enhanced efficacy.

- Functional Foods & Nutraceuticals: Inclusion of bioactive peptides in wellness products to capitalize on preventive healthcare trends.

Challenges

- Low Bioavailability & Stability Issues: Oral peptides are vulnerable to enzymatic degradation and poor absorption.

- High R&D Costs: Developing safe and effective oral peptide therapies requires significant investment.

- Regulatory Hurdles: Strict clinical trials and approval processes are delaying market entry.

- Patient Awareness & Acceptance: Limited understanding of oral peptide therapies may slow adoption in some regions.

- Manufacturing Complexities: Scaling up peptide synthesis and oral formulation production is technically challenging.

Market Segmentation

By Product Type:

- Therapeutic Peptides

- Nutraceutical Peptides

- Functional Proteins

By Application:

- Diabetes & Metabolic Disorders

- Cardiovascular Disorders

- Gastrointestinal Disorders

- Oncology

- Anti-inflammatory & Immunomodulatory

- Others

By Route of Administration:

- Oral Tablets

- Capsules

- Liquid Formulations

- Nutraceutical Integration

By End-Use Industry:

- Pharmaceuticals

- Biotechnology

- Nutraceuticals

- Research & Clinical Labs

By Region:

- North America

- Europe

- Asia-Pacific

- Middle East & Africa

- Latin America

Future Prospectus

By 2035, the oral proteins & peptides market will be characterized by improved oral bioavailability, diverse therapeutic applications, and patient-focused innovations. Advanced delivery systems, AI-assisted formulation design, and combination therapies will promote adoption and enhance patient outcomes. North America and Europe will continue to lead in innovation and approvals, while Asia-Pacific is projected to see robust growth due to increasing healthcare investments, a rising burden of chronic diseases, and expanding consumer awareness.

What Is in This Report?

- Global and regional market forecasts (2024-2035)

- Analysis of growth drivers, restraints, and opportunities

- Detailed segmentation by product type, application, and region

- Technology and delivery innovations for oral peptides

- Competitive landscape with key company profiles

- Regulatory, safety, and reimbursement considerations

- SWOT and Porter's Five Forces analysis

- Strategic roadmap for market entry and expansion

Why Buy This Report?

- Data-Driven Insights: Make well-informed strategic decisions based on reliable forecasts.

- Innovation Radar: Monitor emerging oral peptide technologies and delivery solutions.

- Competitive Benchmarking: Evaluate the pipelines, partnerships, and product launches of key players.

- Market Entry & Expansion Strategy: Identify high-growth regions and applications.

- Regulatory & Reimbursement Guidance: Navigate intricate clinical and approval processes.

- Future-Proof Planning: Align R&D and business strategies with patient-centric trends.

Conclusion

The Oral Proteins & Peptides Market is rapidly evolving, providing convenient, patient-friendly, and therapeutically effective solutions for chronic diseases, metabolic disorders, and functional health applications. Companies that invest in innovative oral delivery systems, ensure regulatory compliance, and expand into emerging markets will seize significant growth opportunities through 2035.